Products & Criteria

Note: Product Fees can now be added to ALL products, including those in the 75% LTV range. View our Product Range Guide.

Fixed Rate and Lifetime Tracker products are available to Individual or Limited Company (SPV) applicants for BTL purchases or remortgages, either as a single mortgage or on a portfolio basis. We can lend on large portfolios and provide a bespoke service – take a look at this case study as an example.

Products are available on standard properties, HMOs, MUFBs, new builds and flats above commercial premises.

- See our Product Range, for details of our rates.

- See our key lending criteria in our All About Zephyr document.

- See our full lending criteria in our Underwriting Guide.

- Use our Illustrative Calculator to see if your case fits.

Our products are for buy-to-let purposes only, excluding consumer buy-to-let. We only lend on properties in England and Wales.

For any questions about our products and criteria, please contact our expert team.

Summary criteria

- Loan Terms from 5 years (minimum) to 35 Years (maximum).

- Unlimited background portfolio – with background portfolio stress testing at 100% of mortgage payments.

- No minimum income for standard applications, £25K gross for professional landlords.

- Directors must hold at least 60% of company shares for Limited Company applications.

- Minor adverse considered.

- Landlords with DSS tenants accepted.

- Applicants must have UK Permanent Right to Reside.

- Maximum age 95 years at the end of the mortgage term.

- To secure a rate a case must proceed to offer within 60 calendar days of an application*

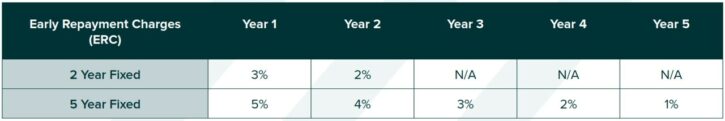

Early Repayment Charges (ERCs)

There are no ERCs on our Lifetime Tracker.

Up to 10% of the outstanding loan amount can be repaid in any 12 month period without incurring an ERC.

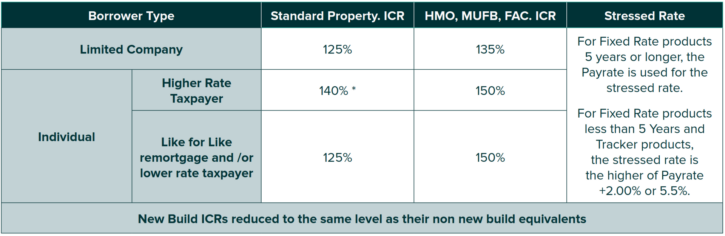

Interest Coverage Ratios (ICRs)

Please note – each application is considered on its merits and we do not guarantee acceptance of all cases which meet our headline criteria. We reserve the right to withdraw products without notice at any time. All mortgage intermediaries are required to comply with our Intermediary Terms of Business. This page was last updated on 26 April 2024.

* If the case doesn’t reach offer stage within these timescales but the application is still progressing, a replacement product can be chosen from the range available at that time. However, if the application is not progressing, we reserve the right to close the case and a new application would need to be submitted.

Consumer Buy To Let: Zephyr Homeloans is unable to lend on a Consumer Buy to Let basis. Where it is identified that an application may be subject to Consumer Buy to Let regulatory requirements, the application will be declined. For example, in the scenario where the applicant or family member has previously resided in the property, and the applicant does not have at least one other BTL property, Zephyr will always view this as a Consumer loan regardless of the time that has elapsed since the period of residence.