‘UK rental values continued to accelerate during 2022’

In their Q4 Rent Index Report, our friends at The Deposit Protection Service (The DPS) – also a part of the Computershare group – reported on the latest trends in the sector based on their huge pool of landlord data. As Zephyr is a specialist buy to let lender, this insight is of great interest to us, and it also makes useful reading for brokers and their landlord clients. So, here are some highlights from the report.

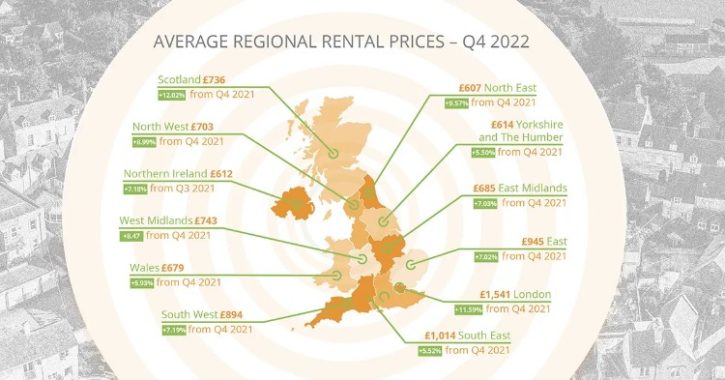

Average UK rents in Q4 2022 were £903: an increase of 1.57% (£14) since the previous quarter and 8.27% (£69) since the last quarter of 2021.

Average annual UK rent is now £1,332 higher than the same time two years ago.

London (11.59%) and Scotland (12.02%) annual growth now ahead of the rate of inflation.

Rents in Yorkshire saw the slowest annual growth between Q4 2021 and Q4 2022, up £32 (5.50%) from £582 to £614. Rents in the South East increased by £53 (5.52%) from £961 to £1,014 during the same period.

Matt Trevett, Managing Director at The DPS said: “The UK’s sustained rent rises are a result of a complex combination of inflationary pressures due to demand for housing. Higher interest rates may also be preventing those tenants who are looking to buy their own property from meeting mortgage affordability criteria, which means they must continue to stay in the private rental sector (PRS). Higher building material costs may also be affecting the pace and price of the construction of new homes, which is also squeezing the supply of properties for rent or purchase.”

Paul Fryers, Managing Director at Zephyr Homeloans, said: “Whilst mortgage interest rates for buy-to-let properties have stabilised during the past few months, landlords must now meet stricter affordability tests. As a result, landlords are under pressure to increase rents to ensure they have sufficient funds. Landlords who want to exercise forbearance for their tenants during the present time may find themselves prioritising their mortgage-related obligations.”

Read the full Q4 2022 Rent Index report and regional summaries here.