Q1 2022 Rent Index report from the DPS is out!

Rents rose again during Q1 2022

Plus, 15% of surveyed tenants report paying above going rate to secure properties

Keep up to date with the latest trends in the BTL market by having a read of the latest Rent Index report from The Deposit Protection Service (The DPS). Like Zephyr, The DPS is owned by Computershare, and with over 1.8m tenancy deposits, The DPS Rent Index reports can provide useful insight to brokers and their landlord clients.

The key headline from the Q1 2022 Rent Index report is that average UK rents have increased for the sixth consecutive quarter, whilst also producing evidence that some tenants are paying above the going rate to secure a property.

Average rents now stand at £849 a month: a £15 (1.80%) increase on £834 in Q4 2021, and a £49 (6.13%) increase on £800 in Q1 2021.

London rents have risen the most in value, increasing £34 (2.46%) on Q4 2021 and £90 (6.79%) since Q1 2021.

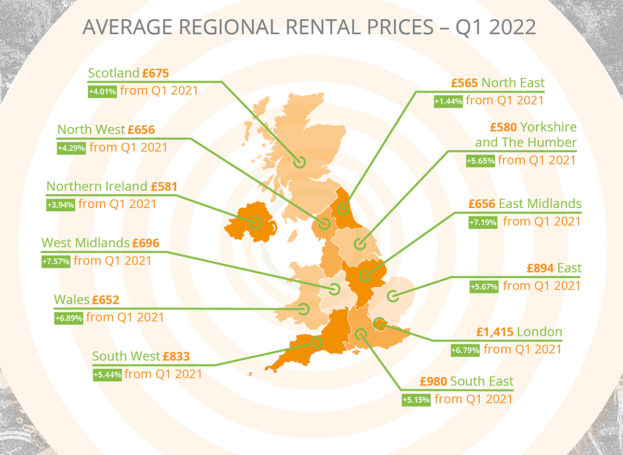

Regional breakdown of average rents:

Flats saw the largest quarterly rise in rents during Q1 2022, with rents rising £16 (1.89%) to £863.

A survey by DPS during Q1 2022 also gave proof that 15% of tenants who responded paid more than advertised rents to secure their property.

Matt Trevett, Managing Director at The DPS, said: “Consistent quarterly rent rises – coupled with survey results that suggest that a proportion of tenants are overpaying to secure a property – underline the current intense demand for, and tight supply of, rental homes in the UK.

“Rents in London are also rebounding strongly, with average rents for flats in the capital increasing by £111 or just under nine per cent during the past twelve months – more than three times the falls seen during 2020, when tenants perhaps sought out more spacious homes outside of the Capital.

“Accelerating rents for flats could signal the beginning of the end of the pandemic trend of renters leaving cities.”

We also spoke to Paul Fryers, Managing Director of Zephyr, who said: “The squeeze on rental stock is also impacting landlords, who are increasingly looking further afield to secure a suitable rental property.

“Recently we’ve seen landlords looking to Northern cities such as Manchester and Liverpool, which are the subject of recent Government investment and where more landlords believe they may find healthier yields.”