UK rent rises outstrip inflation by more than a third

In their Q3 Rent Index Report, our friends at The Deposit Protection Service (The DPS) – also a part of the Computershare group – reported on the latest trends in the sector based on their huge pool of landlord data. As Zephyr is a specialist buy to let lender, this insight is of great interest to us, and it also makes useful reading for brokers and their landlord clients. So, here are some highlights from the report.

The key headline from the Q3 Rent Index is that average UK monthly rents for Q3 2023 were £1,121.46; a rise of 9.13% since Q3 2022. Inflation increased by 6.7% during the same period, meaning that rents outstripped inflation by more than a third (36%)!

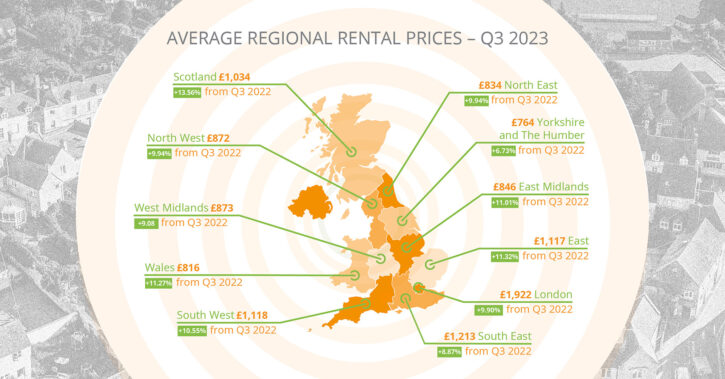

Across the UK regions, Scotland saw the largest annual rent increase at 13.56%, with average rents reaching £1,033. Four other regions – the east, Wales, East Midlands and the south west – also had double figure annual increases.

Yorkshire and The Humber saw the lowest annual increase at 6.73%, taking the average monthly rent to £764.

London saw the largest value increase, with average monthly rents rising to £1,922.

Inflation beating increases for all property types

Average rents for all property types increased over the past 12 months. Flats in the east experienced the highest annual percentage increase of any property type, rising 16.88% to £1,034.

Detached properties in the south east experienced the highest value rent rise, increasing by 12.66% to £1,858.

Keep up to date on future news

Make sure you’re the first to know about future news and insight, such as the quarterly Rent Index, by following Zephyr on LinkedIn and signing up to receive our emails.